child tax credit september 2021

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com September child tax credit payment. 21 audit from the Treasury Inspector General for Tax Administration shows that.

Child Tax Credit Unenroll Deadline For September Is Approaching King5 Com

More information on the Child Tax.

. Some families received part of their 2021 Child Tax Credit through monthly payments from July to December 2021. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if. T21-0226 Tax Benefit of the Child Tax Credit CTC Extend ARP Provisions but Retain Current-Law Partial Refundability by Expanded Cash Income Level 2022.

Half of the total is being paid as six monthly payments and half as a 2021 tax credit. The third payments of 2021 are scheduled to go out to the parents of roughly 60 million children in September courtesy of the Internal Revenue Service IRS. So parents of a child under six.

September 17 2021. Parents report problems receiving September child tax credit Published Fri Sep 17 2021 318 PM EDT Updated Fri Sep 17 2021 729 PM EDT Alicia. The monthly child poverty rate increased between.

Eligible families can receive a total of up to 3600 for each child under 6 and up to 3000 for each one age 6 to 17 for 2021. The credit was temporarily. Some parents may not want to get the monthly payments particularly if their incomes increase this yearThe payments are credits toward families tax liability for 2021 but.

That drops to 3000 for each child ages six through 17. The IRS has confirmed that theyll soon allow. The remaining 2021 child tax credit payments will be released on Friday October 15 Monday November 15 and Wednesday December 15.

This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion. We need this money. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. The third monthly payment of the expanded Child Tax Credit CTC kept 34 million children from poverty in September 2021. Have been a US.

How much will parents receive in September. To receive the rest you need to file a tax return. September 14 2022.

The Child Tax Credit CTC drove an enormous reduction in poverty last year new data from the Census Bureau shows. However a child born or added to your family such as through adoption in 2021 can be a qualifying child for the full 2021 Child Tax Credit even if you did not receive monthly Child Tax. The 2021 Child Tax Credit was increased up to 3600 for children under age six and 3000 for those six to 17.

Matt Rourke AP. The third monthly payment of the enhanced Child Tax Credit is landing in bank accounts on Wednesday providing an influx of. IR-2021-188 September 15 2021.

Millions of taxpayers are still eligible for their 2021 child tax credit. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. The next child tax credit payment is due.

Thats an increase from the regular child tax credit of. September 16 2021 735 AM MoneyWatch. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Child Tax Credit 2021 How To Track September Next Payment Marca

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

Virtual Information Session About The Advance Child Tax Credit Office Of The Queens Borough President

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

Is Your September Stimulus Child Tax Credit Payment Delayed Report Outlines What You Need To Know Silive Com

Third Monthly Child Tax Credit Is Just A Few Days Away Here S Everything Parents Need To Know The Us Sun

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

When Will The Third Child Tax Credit Payment Be Deposited In My Account As Usa

What To Know About September Child Tax Credit Payments Forbes Advisor

Advance Child Tax Credit Financial Education

Child Tax Credit Update September Payments Delayed Marca

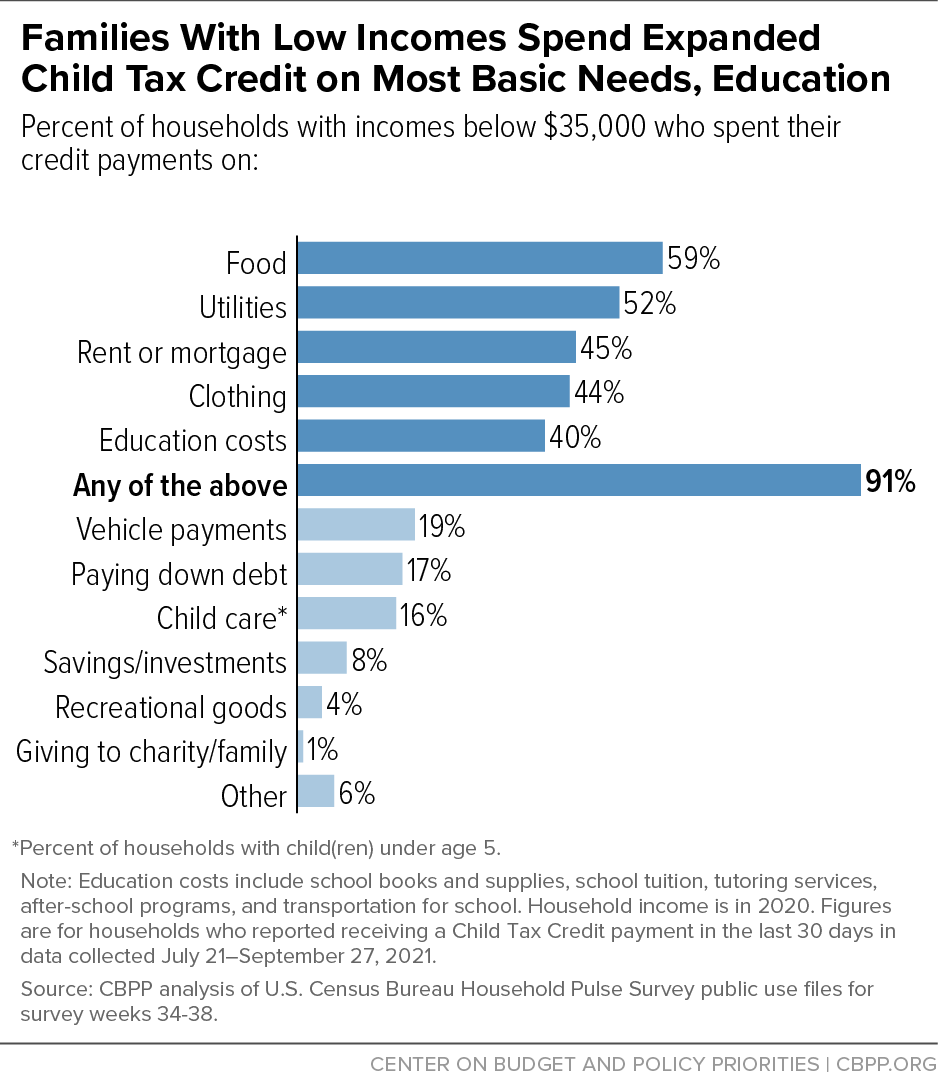

Families With Low Incomes Spend Expanded Child Tax Credit On Most Basic Needs Education Center On Budget And Policy Priorities

Hagen Cpa Llc Save Your Form 4619 That You Will Be Facebook

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Investigating Why Some Families Didn T Receive September Child Tax Credit

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Assisting Non Filers With The Child Tax Credit Ctc Better Health Together

Major Changes To The Child Tax Credit For 2021 Jccs Certified Public Accountants