how to declare mileage on taxes

Deduct your mileage expense to lower your taxable income. Taking the standard mileage deduction is simple.

Are Car Repairs Tax Deductible H R Block

The best way to Create a Mileage Expense Sheet in Excel Begin Excel and choose the File tab.

. Then divide the number you receive by. In this situation you cannot declare. For example if your only miscellaneous deduction is 5000 of mileage expenses in a year you report an AGI of 50000 you must reduce the deduction by 1000 50000.

Total kilometres you drove during the year Total. The mileage tax deduction is calculated by multiplying qualified mileage by the annual rate set by the Internal Revenue Service. The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible costs of operating an.

Every feature included for everyone. To use our calculator just input the type of vehicle and the business miles youve. If you travel away from home for business reasons you can deduct mileage related to those trips as an unreimbursed employee business expense on Schedule A Form 1040.

In addition to providing the number of miles driven during the tax year youll also need to answer a few. The self-employed should multiply the number of miles by the flat rate and claim on the total of this. Add up the mileage for each vehicle type youve used for work.

You would figure your standard mileage rate deduction on IRS Form 2106 and report this amount on Schedule A of IRS Form 1040. Your mileage deduction isnt hard to calculate if youve kept accurate records in your logbook. You must file a tax return if you have net earnings from self-employment of 400 or more from gig work even if its a side job part-time or temporary.

The standard IRS mileage rate for the. So if you traveled 100 miles in a week for business purposes your employer would add 56 100 miles x 056 56 to your next paycheck. Youll need two figures.

If you are an employee you cannot deduct gas mileage as an unreimbursed expense on your tax return. Self-employed individuals will report their mileage on the Schedule C form. How Do You Go about Claiming Mileage Allowance.

Take away any amount your employer pays you towards your costs sometimes called a mileage allowance Approved. You must pay tax on. Uber makes it easy to track your online.

Cars and vans after 10000 miles. Your beginning vehicle mileage. Just multiply the number of miles you ve driven by their corresponding rate.

The Ultimate List Of Self Employment Tax Deductions In 2020 Gusto

Mileage Vs Actual Expenses Which Method Is Best For Me

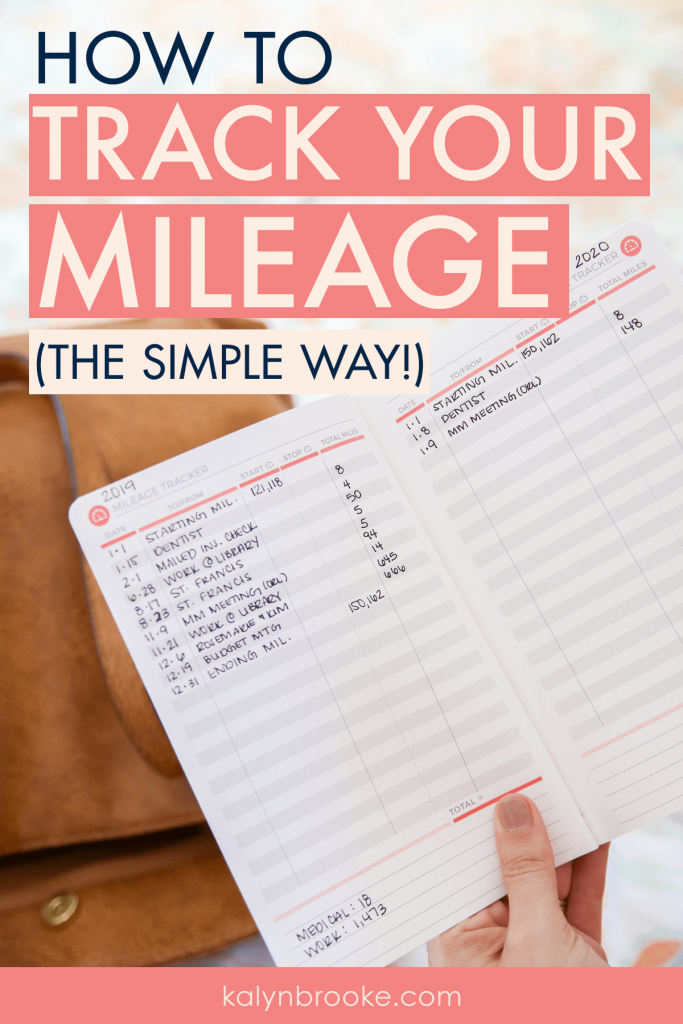

The Simple Mileage Log You Ll Never Forget To Use

What Are The 2021 2022 Irs Mileage Rates Bench Accounting

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

How To Claim A Mileage Tax Deduction In 2020 Mbo Partners

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Mileage Vs Actual Expenses Which Method Is Best For Me

How To Claim The Mileage Deduction Write Off Car Expenses Uber Eats

2022 Irs Mileage Rate What Businesses Need To Know

Deducting Auto Expenses Tax Guide 1040 Com File Your Taxes Online

Should I Track Miles For Taxes Keeper Tax

Self Employed Worker Mileage Deduction Guide Triplog

Hurdlr Mileage Expense Tax Apps On Google Play

Stride Mileage Tax Tracker Apps On Google Play

Top 7 Mistakes That Rideshare Drivers Make At Tax Time Stride Blog